Spanish Mortgage Floor Clauses

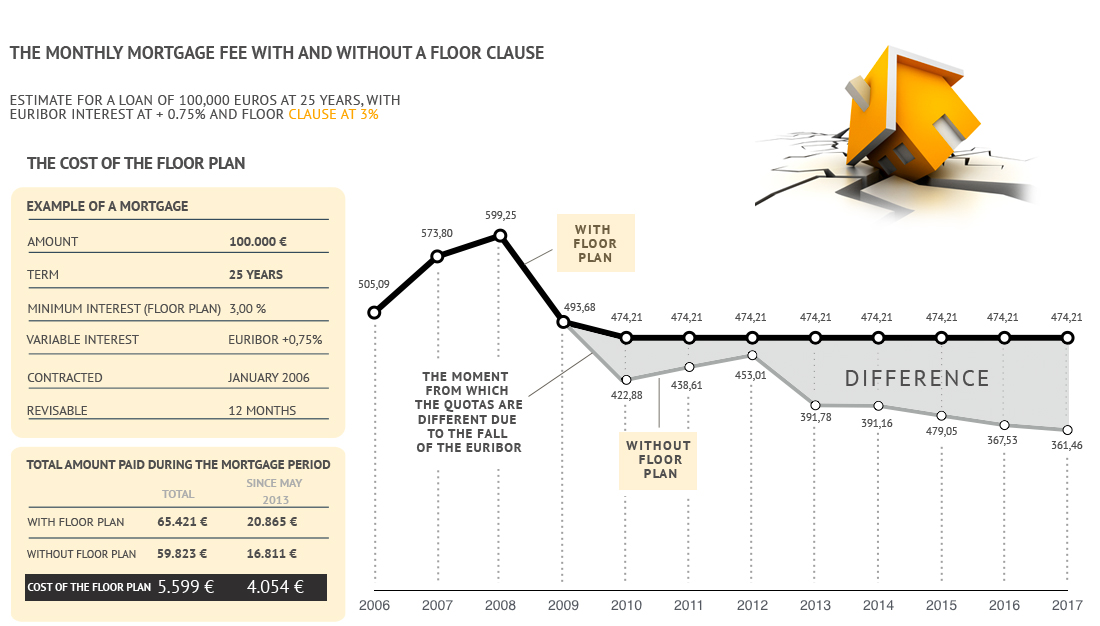

Floor clause basically in spain most mortgage loans are referred to the euribor rate plus a differential.

Spanish mortgage floor clauses. For most spanish mortgages the interest rate payable is calculated by reference to euribor or irph. The way that the floor clause was inserted into the mortgage agreement and how this was explained by the spanish bank to customers was not always clear or straightforward. Top 10 spanish mortgage abusive clauses. After the eu s ruling that the floor clause was abusive the spanish government set up a process to ensure that claims are dealt with swiftly.

Banks that simply removed the floor clause without taking any further action have also been sentenced to reimburse their clients. Clausula suelo floor clause 2. Free check spanish mortgage with floor clauses closer to a definitive solution for those affected the first thing i would like to do is inform you that c d solicitors has signed a collaboration agreement with the sevillian law firm gallego rivas which specialises in financial and banking law. A floor clause is the term used when the monthly interest on a mortgage does not go below a certain percentage if so then this clause could be considered to be abusive as a result of a spanish supreme court decision dated 9 may 2013.

Traditionally the borrower pays the set up costs for a spanish mortgage which amount to about 10 of the property s sales price and include registration fees notary fees and taxes. Irhp mortgage loan reference index 3. For most spanish variables rate mortgages the interest rate payable is calculated by reference rate to euro interbank offered rate euribor. A floor clause or clausulas suelo in spanish is simply a clause that has been inserted into mortgage agreements by some spanish banks that affects the interest rate payable on the mortgage.

The following list is not a closed one meaning i will only include the most common ones. A floor clause also known as clausula suelo or suelo hipotecario is simply a clause that has been inserted into variable rate mortgage agreements in spain during the last 20 years that affects the interest rate payable on the mortgage. Despite the clogged up spanish legal system causing delays for mortgage floor clause claims in 2017 taking your lender to court is still the most effective way to obtain a full refund on overpaid mortgage interest and the judicial authorities have announced measures to speed up claims in 2018. However patience is still necessary.

While the floor clauses chaos rages there are two further sources of potential windfalls for borrowers and pain for spanish banks. There are three types of claims on each mortgage. Mortgage fees valuation fee notary fee loan fee.